Privacy coins explained

The goal of cryptocurrencies is to create a currency in which nobody has the power to create funds or can control all the funds. Supporting this notion is the blockchain technology, which allows a decentralised trading process to take place digitally by swapping cryptocurrency tokens.

However, an inherent issue in the goal of decentralising the monetary system is that it typically results in the removal of any degree of privacy and transaction confidentiality. Unfortunately, the Bitcoin blockchain system relies upon such system transparency and auditing capabilities to operate.

Every piece of Bitcoin can be traced back to its creation, and the Bitcoin addresses of all holders are public. All it takes is a link between you and your Bitcoin address, and your private finances could suddenly become public information.

This is a significant moral issue, as it may be possible to track down an individual’s Bitcoin activity and glimpse into their spending habits. Further, it is also an economic issue for businesses and corporations who need to keep financial information private.

Bank accounts are digital, but lack the privacy of cash.

Privacy coins aim to work around these apparent limitations in the blockchain system, fulfilling the market demand for a cryptocurrency where transactions and holdings are hidden. These currencies are decentralised, private and digital.

At the forefront of privacy coin development are a select group of five coins: Dash, Monero, Zcash, PIVX and Verge. Below, we’ll take a deep look into the similarities and differences of market leaders Zcash and Monero.

Introducing Zcash

Zcash brands itself “the first open, permissionless cryptocurrency that can fully protect the privacy of transactions using zero-knowledge cryptography”.

Zcash and its variations are all derived from the peer-reviewed Zerocash whitepaper. Whilst Zcash’s notable predecessor Zerocoin is an extension to add anonymity exclusively to the Bitcoin network, Zcash was announced as a “full-fledged” cryptocurrency that operates independently of the Bitcoin project.

Founded in October 2016, Zcash is a young coin developed by the for-profit Zcash company. Instead of raising capital from an initial coin offering like most coins, the team takes a 20% ‘founders reward’ from mining rewards to fund operations and pay investor returns.

Zcash is based on a cryptography protocol called zk-SNARKs, which we’ll explain the significance of in the technical section of this guide.

Introducing Monero

Monero is an older cryptocurrency created in April 2014 based on the CryptoNote protocol.

As one of the oldest privacy coins, Monero has faced its fair share of crises. In September 2014, an exploit in CryptoNote was found and abused by a hacker, splitting Monero into two separate blockchains.

In mid 2017, illegal black market trading website and Monero adopter Alphabay was shut down by authorities and had its assets seized. Monero protected many of the users who used Alphabay from being traced by the FBI.

In addition to a strong volunteer and community backing, Monero’s extensive history gives it an edge in a privacy coin market driven by trust.

Coin comparison

Whether you’re a privacy coin investor or user, it’s useful to have an intuitive understanding of the protocol differences behind the coins. Zcash and Monero are incredibly competitive and have several unique advantages over each other, so the facts should guide your decisions.

Key differences

| Monero | Zcash | |

| Inflation | Low, decreases over time | Moderate, decreases over time |

| Illicit trading | Involved in the past | Not trusted enough |

| Currency governance | Run by community contributions & volunteer developers | Owned by a for-profit company backed by investors |

| Mining | Orthodox; similar to Bitcoin | New memory-orientated mining, unique mining fee collected |

| Scalability | Could be an issue, but has plenty of headroom | Working on Zcash sapling to address scalability |

| Security protocol | Applies to everyone, fast and effective. Mathematically breachable | Optional, slower but mathematically impossible to track |

| Future | Kovri privacy update, Bulletproof performance update | Sapling performance update, Ethereum privacy collaboration |

Investment details

Inflation rates

Nearly all regular fiat currencies we use on a day-to-day basis have inflation due to Government currency creation. On its simplest level, an increased volume in currency results in slightly less spending power for everyone; we call this inflation.

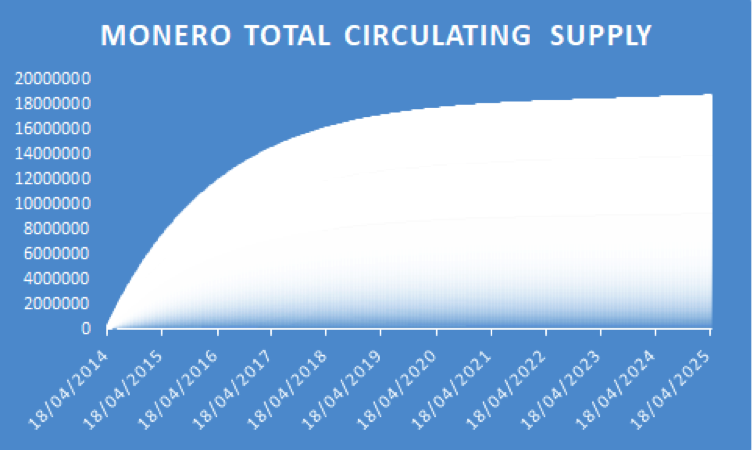

Monero has a consistent inflation rate of 0.3 Monero per minute, effectively forever. This is inserted into circulation by giving the tokens to miners who help to verify Monero payments.

If you can visualise this trend, the amount of Monero in the system will always be increasing, but as time goes on that 0.3 Monero will be a smaller and smaller percentage of the existing coins. By 2022, the inflation rate will be next to 0% a year.

Monero coins in supply over time. Original data source: BTC vs XMR

This system keeps an incentive for miners at all times whilst keeping inflation modest for investors. Overall, Monero’s inflation rate is low and will continually improve.

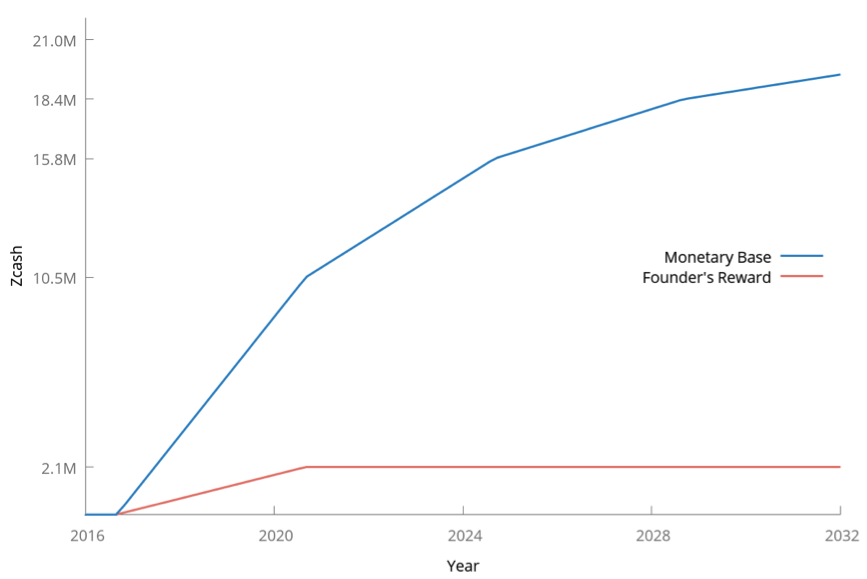

On the other side, Zcash’s inflation rate is somewhat similar. They add 50 Zcash tokens to the system every 10 minutes, and halve this amount about every 4 years.

The result is a similar curve taking a comparable logarithmic shape, though stretched.

Zcash supply over time. Source: Official Zcash blog

The stretch means that Zcash will hit close to a 0% inflation rate much further down the line in 2032, and investors in the early days will need to bear the huge inflation rates of 300-400% a year.

In summary, Zcash and Monero have similar supply systems, but Monero inflation rates will be much lower throughout the 2010 decade.

Illicit trading market

It’s certainly not illegal to posses or trade Monero tokens, but the cryptocurrency markets have had a long association with illegal activities.

The two iterations of the Silk Road black market website both used Bitcoin to help provide anonymity. When they were shut down, Bitcoin prices took a plunge in response.

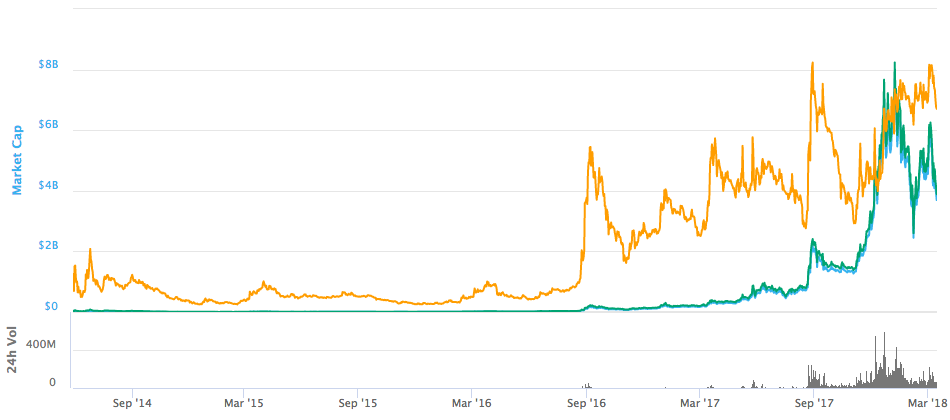

Being a privacy coin, Monero was once available as a payment option on illegal market AlphaBay. Despite speculation, it was clear after AlphaBay’s collapse that Monero didn’t rely on it to survive;.Monero’s price was hit, but quickly recovered.

USD/Monoro price history. Source: CoinMarketCap

If you’re an investor, it’s worth tracking the illegal markets that using Monero. (Don’t use them yourself!).

Currency governance

All cryptocurrencies are, despite the decentralised goal, run by somebody.

Zcash, as mentioned earlier, is run by a for-profit business that takes a portion of mining rewards as funding. Many still believe that the team can manage it effectively, but there appears to be a lack of community involvement. The official Zcash forum is meant to be the central contact point with Zcash developers, but it’s not terribly active.

As a private project, auditability is a major issue for Zcash. In theory, it’s possible to sneak an exploit into the code and take over the cryptocurrency, perhaps by printing infinite funds. To address this, Zcash invests heavily in external audits of their operations.

Zcash also has a number of financial investors in the project. These range from blockchain believers to major financial firms. In return for a proportion of the profit, which is made through the collected founder rewards.

Contrastingly, Monero is a typical cryptocurrency run by a grassroots team of volunteers who are funded by public donors. Because the project is open to everyone, the implementation of updates is done by consensus, thus making malicious code harder to sneak in. Even the Monero team’s meeting logs are available online to see.

Diving deep: the technical details

Mining

Both Zcash and Monero use the proof of work system to authenticate transactions. Proof of work is a system wherein transactions are verified by a group of miners who solve difficult mathematical problems with computer hardware.

Zcash uses a new mining system called Equihash. Equihash is a memory-oriented mining implementation. This means that it uses the temporary data storage built into computers to authenticate transactions.

This is done to address the potential for conniving miners to custom build hardware (ASICs) that could take over the blockchain. The Zcash blog comments that it is “unlikely that anyone will be able to build cost-effective custom hardware (ASICs) for mining in the foreseeable future”.

The use of Application Specific Integrated Circuits (ASICs) is prevented by Zcash. Source: fotoblend

Contrastingly, Monero is much more in line with Bitcoin and has a CPU/GPU centered mining process.

Its mining protocols are also designed to be ASIC-resistant, and the Monero team’s update logs show that they are continually implementing changes to work against the feasibility of ASICs.

Its orthodox mining system makes Monero a popular mining option for home setups. The Monero website itself guides users through the process and large communities discuss the mining of the coin.

Scalability

On a technical level, each block filled with transactions added to the blockchain increases its file size. Consequently, blockchains such as Bitcoin have suffered ‘scalability’ issues in the past wherein transaction fees and waiting times soared due to the network issues. Since each new block relies upon the previous, solving the scalability in cryptocurrency is one of the most active research areas.

Zcash’s use of its new privacy protocol zkSNARKs provides it with a system that “reduces both the proof size and the verification time tremendously”.

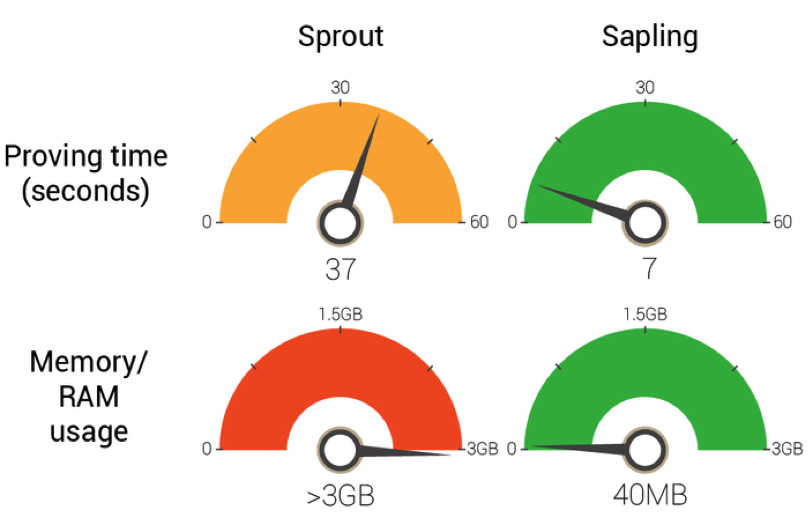

Additionally, Zcash’s new zkSNARKs revision Sapling could shoot down scaling concerns even further if successfully implemented.

Promotional image estimating Sapling’s potential improvements to zCash scalability. Source: Official Zcash blog.

On the other hand, Monero’s security protocols inflate the size of each block, leading to a less scalable system. Whilst this could mean the demise of the currency if it sees a large increase in transactions, Monero miners are quick to point out that the coin still has plenty of headroom. In combination with improved technology, scalability might not be an issue.

Security protocol differences

Fully understanding the security protocols behind privacy is quite a challenge. Monero even keeps a glossary of key terms. However, it’s imperative to have a basic understanding of the digital cryptography behind each coin if you’re looking to buy.

zCash’s zkSNARKs

Don’t let the name ‘zero-knowledge succinct non-interactive argument of knowledge’ turn you off. zkSNARKs is the privacy system behind zCash. There’s a few main traits to it:

- It offers an authentication method that allows two parties to verify they have the same information without revealing any of it to each other. Some good analogies are proving to someone you have more wealth without revealing any information about how much, or proving to a friend that you found Waldo in a game of Where’s Waldo without pointing to him. zkSNARKs, on a mathematical level, provably solves these problems and confirms privacy.

- It takes a fair bit of resources. In zCash, using zkSNARKs to hide your transaction is optional. In fact, less than 10% of zCash is held with privacy protection. This is due to the higher transaction times and costs involved in executing the zkSNARKs protocol in a payment. As a result, most zCash in the network can actually be traced.

If you’re interested, read more on the Zcash blog posts or dive in to Ethereum cofounder Vitalik Buterin’s in-depth explanations of the topic.

Monero’s Ring CT

Monero uses ‘ring confidential transactions’, along with some other privacy measures, to hide all Monero activity. Here’s what you need to know

- Ring CT makes it computationally infeasible to link transactions to you. It does this by generating a digital signature from multiple people sending transactions, so the verifier knows it’s legitimate without knowing who the one sending the currency is. An analogy offered by the Monero blog is a letter signed ‘Government officials’; you can trust the signature but don’t know which official wrote it.

- It’s enforced on all Monero transactions. Unlike zCash, all Monero tokens are shielded by the Ring CT protocol.

Some more good places to research Ring CT are the Monero blog and GetMonero.com’s promotional videos.

The key difference between the privacy systems of Monero and Zcash is that Monero’s protection takes impossibly long to break, wheras Zcash is fundamentally unbreakable.

Planned updates

Monero Kovri

Monero Kovri is yet another addition to the set of privacy protocols developed by the team.

Kovri is based on the ideas of the Invisible Internet Project (I2P). After its implementation, user’s Internet Protocol (IP) addresses, which could be considered internet nametags, will be hidden in Monero transactions. In the context of Ring CT, this means that not only is it impossible to tell which signer started the transaction, but who any of them even are.

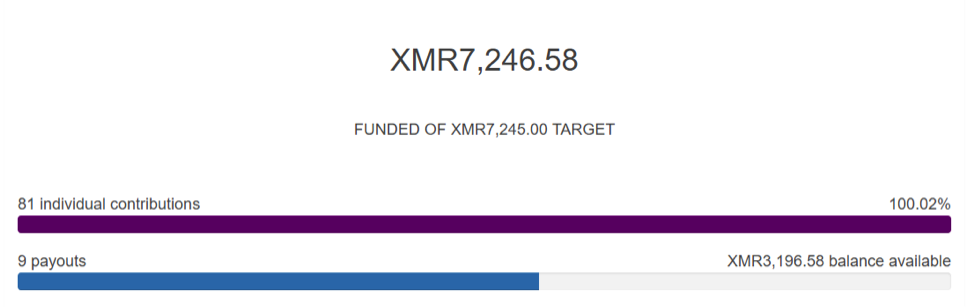

The Monero forum shows that the Kovri project has already been fully funded and that work is underway. The Monero forum shows the current funding of projects. The above project is Kovri.

The project page puts it this way: “It’s simple: more users, more trust, more value.”

Under the Monero vision, working on Monero’s layers of security is the key to success.

Monero Bulletproof

Monero’s upcoming bulletproof implementation is its next major performance upgrade. It builds upon a security feature called range proofing. Range proofing is responsible for hiding the transaction amount, whilst still ensuring that the right amount of Monero is involved.

The bulletproof extension reduces the size of the files needed to range proof, improving mining and transaction performance.

Zcash Sapling

As mentioned in the scalability portion of this guide, Zcash Sapling is a major network upgrade that’s set to improve network speed and stability around ten-fold.

It’s part of the Zcash effort to grow the size of its security features by making them more practical for users.

You can watch for Sapling-related announcements by following the Zcash blog tag.

Zcash and Ethereum

In such a competitive cryptocurrency environment, it seems natural to see all coins and opposition to each other. However, in a rare love story, Zcash and Ethereum have decided that they could do more if they just worked together.

Zcash and Ethereum staff at a joint meeting. Source: Official Zcash blog

Their plan is to implement a simplified version of Zcash’s privacy protocol, zkSNARKs, into Ethereum. The collaboration adds tremendous value and experience to both projects.