Building a Smart Economy

Blockchain technology could revolutionize power and control. From music rights to inter-bank transactions, the latest tech entrepreneurs have been trying to bring the blockchain’s benefits to industry applications.

Building a blockchain from scratch is expensive and technically difficult, so Lisk and Ethereum provide developers with templates and existing infrastructure to kick-start their ideas.

If our future truly is decentralized, then these two projects could become the basis of a new digital economy.

Introducing Ethereum

The Ethereum platform is a giant entrepreneurial hub for blockchain projects.

Ethereum helps developers interface with and harness the blockchain, whether that be to create the next big cryptocurrency, a trustless commercial service or execute a financial instrument.

It’s founded by blockchain aficionado Vitalik Buterin, who proposed its whitepaper in 2013. He provides his thoughts on new blockchain technologies in his must-read regular Medium posts. Buterin has a tremendously innovative mindset, but isn’t afraid to clash with his critics in drawn-out technical discussions.

Ethereum was an early blockchain project, and has had years of development and community growth. Its blockchain’s influence is only second to Bitcoin’s, though it is the industry leader for blockchain services.

Officially, Ethereum is now run by a Swiss nonprofit called the Ethereum Foundation, but its work is backed by a range of investors including Fortune 500 companies.

Introducing Lisk

Lisk is a similar project that wants to host decentralized applications. Their focus isn’t becoming the fastest or most secure blockchain, but to make the platform as easy to use as possible.

By providing developers with independent blockchains, called ‘sidechains’, running off the power of the Lisk mainchain, projects are given autonomy from the network. Other design choices reflect their intent to make Lisk development flexible and painless.

Lisk founders Oliver Beddows and Max Kordek started as developers for a similar token, Crypti. However, they decided that there was a “huge lack of progress” with the project. They saw an opportunity to bring the code open-source, introduce forging rewards and make some other technical changes. Feeling resistance against their visions in the Crypti team, they founded Lisk in 2016.

Lisk’s market share is a fraction of Ethereum’s, but if its accessibility plans pay off it could be the home of many early blockchain applications. At present, sidechain projects are manually set up by the Lisk team, but their public software development kit (SDK) in 2019 will open up the platform to everyone.

Key Differences

| Ethereum | Lisk | |

| Mission | Facilitate a smart economy | Make a simple blockchain creation platform |

| Inflation | Under 15% p.a., reducing with time | Under 6%, dropping to 2% in 2020 |

| Industry adoption | Very high | Limited |

| Currency governance | Open proposal system | Community developers |

| Funding | Extremely large | Large |

| Protocol | PoW, moving to PoS | DPoS |

| Transaction bandwidth | Little, high potential under PoS | Little, more after scaling issues are solved |

| Scalability | Layering, sharding and implementing PoS | Will be solved after their SDK release |

| Future | Focus on its blockchain’s performance | Focus on industry adoption |

Investor Information

Industry Adoption

Ethereum

Ethereum has had their decentralised application (dApp) platform open for several years. Prominent apps can be found on Ethereum’s state of the dapps website. It lists over 1,700 projects, including games, peer-to-peer marketplaces and early industry applications.

One now-infamous Ethereum blockchain project is cryptokitties, a virtual cat trading game. In 2017, the game grew so big that the entire Ethereum network began to collapse under the network load.

However, many of Ethereum’s important applications are still in the pipelines.

In early 2017 Ethereum launched the non-profit Enterprise Ethereum Alliance (EEA), pulling together an impressive range of over 100 companies interested in the potential of blockchain technologies. It gives Ethereum a link to crucial industry leaders in the financial sector such as J.P Morgan, ING, UBS and MasterCard. Tech research giants Microsoft, Intel and the Toyota Research Group are also involved.

One of the EEA’s core missions is to provide “resources for businesses to learn about Ethereum and leverage this groundbreaking technology to address specific industry use cases”. Their board comprises of industry founders, managers and researchers all keen to make developments with dApps.

Ethereum investors believe that blockchain technology will revolutionise every industry, from agriculture to data storage. If this truly is the future, then Ethereum looks set be the pioneer of a new decentralised world.

Lisk

Lisk is still yet to release its software development kit (SDK) to the public. Its SDK is also referred to as the ‘sidechain development kit’. Once available, it will allow programmers all over the world to begin creating dApps through Lisk sidechains with ease. The SDK’s release is expected some time in 2018.

Although its SDK is still upcoming, some projects have begun working without it. Some plan to revolutionise digital privacy, academic accreditation and music.

Cofounder Max Kordek has pledged $50 million USD of Lisk tokens towards supporting projects built on its network.

Currency Governance and Team

Ethereum

The Ethereum Foundation, the organisation behind the Ethereum project, is still led by its original founder Vitalik Buterin.

There are over 40 full-time employees as well as more part-time workers and volunteers.

Although there are countless community developers for the Ethereum platform, Buterin is the figurehead for the entire project. He writes on Medium and his personal website, but follow the Ethereum blog for the latest news on the project.

Changes to Ethereum are made through Ethereum Improvement Proposals, which once accepted are implemented into a hard fork of the Ethereum blockchain.

However, the protocol is ultimately still governed by the network; not all hard forks are accepted by Etherem’s nodes. Ethereum has tried to tie up hacked funds, but some argue that it conflicts with the Ethereum’s hands-off philosophy.

In one high profile refund fork, called the DAO fork, the refund was rejected by a large part of the community, resulting in the Ethereum Classic fork.

Ethereum Classic uses the code as law. What happens is decided by the code and all interactions with the network occur voluntarily. That is, hacks cannot undone in Ethereum Classic.

Lisk

Lisk was originally founded by Crypti developers Oliver Beddows and Max Kordek.

Kordek has an extensive background in the blockchain research area, whilst Beddows is an all-round (‘full stack’) developer; making Lisk both innovative and practical.

Kordek is active on Twitter and the broader community, participating in interviews to act as a speaking developer on the state of the project.

The pair frequently publish on the official Lisk blog, keeping the community up to date on the direction of the coin.

Since their inception, the Lisk team has grown to over 50, working on developing, marketing and managing the platform. They also hire a large number of official representatives worldwide to help run events, translate and spread the word about the coin.

The large team means that Lisk is constantly developing their platform, pushing out frequent updates to improve and supporting developers to grow the community. They’re also able to host live conferences and meetups to discuss the platform.

Project Funding

Ethereum

Ethereum has long been plagued by funding troubles, at one point only having one year’s worth of runway left before funding was dried up.

However, thanks to a range of private investors, Ethereum is now one of the most well-funded blockchain projects with enough capital to keep up intensive development efforts for over 4 more years.

Their funds are spread across multiple currencies to reduce portfolio volatility. In 2017, their assets were reported as follows:

- $15 million in fiat (mostly Euros and Swiss Francs)

- 500 Bitcoin

- 800,000 Ethereum

This puts Ethereum’s capital at around $400 million USD.

If Ethereum is successful, it will be able to receive additional funding from the dApps that rely on it. This source has begun to contribute already, with a record $100 million being raised in 2018 from six companies based on the Ethereum network.

Lisk

The Lisk project is also among the best funded cryptocurrency projects out there. They currently have around $100 million USD in funds. Their initial coin offering raised Bitcoin funds (14,000 BTC) and the price of Bitcoin has exponentially grown, so their initial supply of $6 million has increased more than ten-fold.

They’ve since received funding from a number of additional sources, and the most recent report from the Lisk team is that they have around 6 years of funding remaining at the current market rates of their assets.

Inflation Rates

Ethereum

Ethereum’s current proof of work protocol provides a reward in Ethereum tokens to miners who help to validate transactions by solving complex mathematical problems.

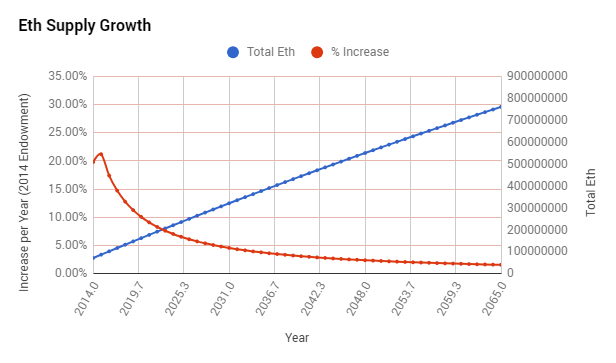

The current issuance rate of Ethereum is a set volume per year. However, this means that the inflation rate decreases over time because the pool of funds also grows.

Ethereum total supply (blue) and inflation rate (red). Data source.

The inflation rate slowly decreases over time before it reaches close to zero, but the amount of Ethereum in supply each year still increases linearly. There is no token cap.

Ethereum plans to make the switch to the Proof of Work protocol. According to founder Vitalik Buterin, will result in zero to tiny issuance rates and no inflation.

Lisk

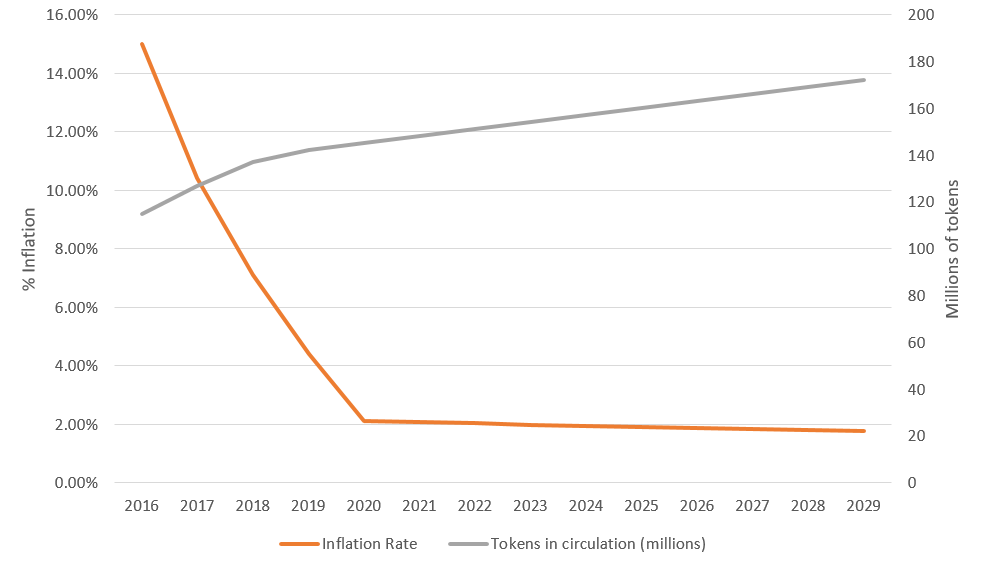

In order to encourage participation in validating each block, a forging reward of 5 Lisk tokens is given out per block. This means that the pool of Lisk is slowly increasing over time, just like a regular fiat currency such as USD.

This system can be compared to the Lisk in circulation to find its annual inflation rate.

For Lisk, the worst of inflation is behind it, so you can be fairly certain inflation will have a minimal impact on your investment returns. However, there is no maximum token supply.

Due to the forging system, the creation of new coins goes to rewarding those who assist in validating blocks. Consequently, inflation keeps the Lisk coin competitive in the market, and facilitates its decentralization.

Diving Deep — The Technical Differences

Decentralized Applications

Blockchains have applications in a wide variety of industries, but not all of these projects need a unique blockchain architecture. Many cryptocurrencies are only trying to fill a niche. Some commercial integrations of the blockchain will also need to be duplicated for each business, so starting a blockchain from scratch for each is inefficient.

Decentralised applications are duplicable networks that are powered by other blockchains.

Both Ethereum and Lisk have the same goal of becoming the blockchain of choice for projects that can benefit from the technology. Usage of their blockchains will directly result in an increase in token demand and price.

Sidechains

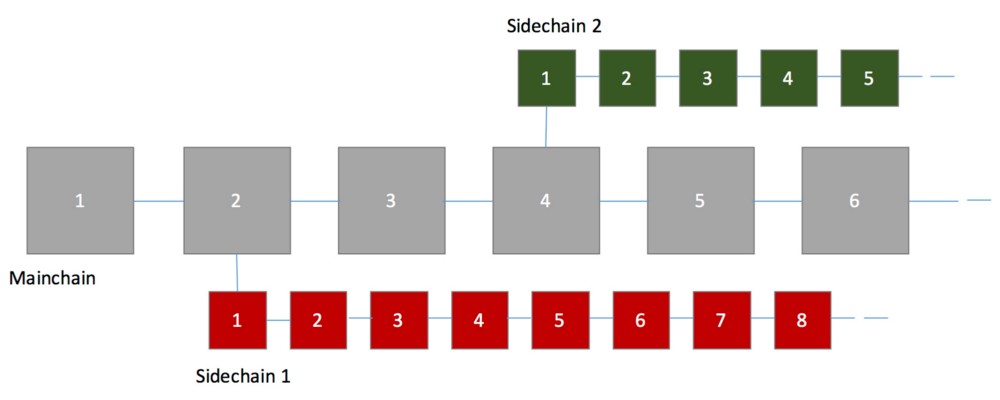

Lisk has a focus on providing independence for projects on their platform. Instead of being tied to the core blockchain (mainchain) like an Ethereum project, Lisk projects are given their own sidechain.

The above diagram represents the Lisk network. The grey mainchain running in the centre is the core Lisk blockchain. When a developer wants to start their own blockchain based on the Lisk protocol, they set aside Lisk tokens and tell the network that they wish to start a sidechain. Sidechains operate on a proof of stake protocol by default, but it is up to the owner how they wish to delegate authority on their network.

Sidechains are valuable because they do not carry the weight of the mainchain, only the transactions before it. Additionally, because sidechains operate independently, a failure in a sidechain has no effect on the Lisk service. Sidechain tokens cannot be traded for Lisk tokens, unless the developer is yet to issue tokens out to the public.

Lisk’s can provide organisations with their own, independent blockchain. Projects that lack resources to develop a blockchain from the bottom-up, as well as experimental projects, might opt for Lisk.

Smart Contracts

One of the weaknesses to the modern financial system is its reliance on trust. When an consumer deposits funds for a good or service, they do so will the expectation that they will only be charged if it is provided. However, there is little legal backing of these agreements, and we often have to rely on Government intervention to eliminate untrustworthy players.

The solution, first proposed by researcher Nick Szabo (who could be ‘Satoshi Nakamoto’, the anonymous founder of Bitcoin) in 1996, is a smart contract.

The idea is that a transaction can occur without needing a credible third party, such as the Government, to guarantee and verify it. Instead, the guarantee of a smart contract comes from the fact that it is written in computer code that cannot be modified or lied to. In the simplest case, it looks for when the network accepts an event has occurred and then executes part of the contract. For example, it can charge for package delivery only once it is delivered, or send a financial product once a payment has been received.

We can extend this idea by placing the contract on a block entered into a blockchain. Lisk and Ethereum both host smart contracts. Once submitted, the contract is immutable and cannot be changed. This makes the entire process trustless.

The clearest, active use of blockchain smart contracts are decentralised exchanges such as IDEX. All of its transactions and deposits are backed by smart contracts, so the company running the service does not have to be trusted. The code of the smart contract is designed so that, even if the exchange were to disappear, investors could still withdraw their funds by executing a contract on the blockchain.

Ethereum and Lisk both have smart contracts running on their platform. However, it is a major focus for the Ethereum. They already have a marketplace for smart contract execution, charging users the gas unit. When a new token is created on Ethereum, it is run through a network of smart contracts. This makes Ethereum projects reliant on the mainchain.

Developer Offerings

Lisk uses Javascript, an extremely simple and well-known programming language. This fits their core mission of providing a simple blockchain interface.

Javascript has companies such as Google and Microsoft working on optimising the language, is applied to a wide range of applications and has a healthy following. In fact, Javascript could even be the most popular programming language.

Lisk’s founders openly state that they “chose JavaScript because it runs literally everywhere (and) is extremely popular and widespread”.

However, the consequences are that Javascript has security concerns and is often thought as an inefficient but ‘quick and easy’ language.

In contrast, Ethereum has two programming languages, Solidity and Viper. Both are secluded languages developed solely for use on the Ethereum virtual machine that runs its smart contracts.

Although Ethereum developers must learn one of these languages, they interact more efficiently with the Ethereum machine. Since blockchain networks have limited bandwidth, using the blockchain to manage a smart contract costs money. Ultimately, an efficient language represents business savings.

This fits Ethereum’s intention to attract big technology companies and dedicated blockchain developers. However, it forces out many of blockchain’s experimental projects, and new developers who are faced with the task of learning a whole language for a test.

Protocol Differences

Most early cryptocurrencies, including Ethereum, are grounded on proof of work systems that require nodes in the network to solve difficult mathematical problems. When a node finds a correct answer, it receives a reward and can propose the next block to the network.

Proof of work has a range of issues. For example, they use enough electricity to power whole countries, centralize mining in countries with cheaper electricity, and are susceptible to mining pool attacks because they have to specify a mining difficulty for nodes.

Consequently, Ethereum is working on switching their protocol to proof of stake in the Casper upgrade. Ethereum’s proof of stake will require validators to deposit tokens and ‘bet’ on which block will be added to the chain next. Correct bets will be rewarded, so contributors are incentivised to vote for the correct block.

There’s much more to it, but proof of stake ultimately promises to take hardware out of the block verification process.

Lisk uses a similar proof of stake system, but is already running on it. Lisk holders can easily vote for a validator with their tokens from their cryptocurrency wallet. One of the top 101 voted validators is then randomly selected to become the delegate who decides on the next block.

Transaction Speed and Scalability

Payment processors such as VISA use a huge amount of computing power to manage and secure their networks. If NEO and Ethereum want to revolutionize entire industries, their systems must have theoretical maximums above the requirements to manage a smart economy.

The speed of a protocol is measured in transactions per second (tps). VISA’s network uses 2,000 tps. Further, the systems have current, practical speeds and theoretical maximum speeds that they may be able to reach in the future.

Each block in a blockchain contains a number of transactions, and this number is only limited by the protocol. Additionally, the speed at which those blocks are added also varies between protocols.

There are 10-19 seconds between Ethereum blocks, and 10 seconds between Lisk blocks. However, both projects are keeping their blocks small whilst they continue to make major upgrades. Lisk is at 2.5tps (25 transactions per block), whilst Ethereum’s miners have control over the size of its blocks, and are currently keeping at around 15 tps.

The risks of leaving the block size up to miners is a common critique of the Ethereum network, as its ability to scale rests on their goodwill to keep at reasonable levels. The block time is also being deliberately slowed whilst proof of stake in implemented, and will get slower as the project approaches the switch.

When both cryptocurrencies are running proof of stake protocols, they will be able publish transactions rapidly. They are only limited by:

- The speed at which their validators can publish blocks

- The blockchain and block size nodes are able to copy and keep on their machines

So whilst the theoretical limit of proof of stake is well over 100,000 tps, practical improvements can only be made by optimising the protocol or only allowing the fastest actors; which would centralise the network.

Ethereum’s Future: Protocol Improvements

Vitalik’s plan is to fix the problems revealed by the Crypto Kitties embarrassment and drive up the speed of the system without centralising their network.

Ethereum’s road-map is to:

- Implement second-layer network solutions that can reduce the congestion on the Ethereum blockchain. This includes Ethereum Plasma, which allows projects to operate on their own child chain whilst still being backed by the main Ethereum token. TrueBit is another layered solution enabling more complex smart contracts by allowing them to be executed by ‘solvers’ off-chain. State channels will also bring regular Ethereum payments off the blockchain, in a system similar to Bitcoin’s lightning network.

- Introduce Ethereum Sharding, which won’t require all nodes to store the entire blockchain. Some parts will only be held by some nodes and called upon when necessary. Although it limits the availability of the data, it should allow more machines to participate in the network and increase its throughput.

- Switch to proof of work in the Serenity update described above. The transition will be slow, and block rewards will progressively be decreased as it is implemented.

- Offer privacy and verification options to users through their zCash partnership. The Ethereum network still needs more work before it can handle the network.

The Lisk SDK

For years, Lisk fell behind other projects because of their slow SDK release. Throughout the growth of 2018, the Lisk team failed to realease the SDK that allowed for development on the platform, instead working on a rebranding.

In 2019, Lisk released the SDK and has just about completed the steps on their SDK roadmap.

The project needs to develop a marketplace and community of blockchain developers, and then work on making their protocol competitive. Reactions of developers to Lisk’s SDK will reveal if it has the potential to take out Ethereum.

Lisk’s Path Forward

At the monent, Lisks goal is to improve their SDK and transaction throughput.

You can keep up to date with all their current projects on their roadmap.

Two Projects Looking for a Breakthrough

Ethereum and Lisk have both seen decentralised applications on their platforms, are well funded and are working strenuously to make appealing blockchains for new projects. Ethereum is older, and has caught more institutional interest that has led them down a business-oriented path. On the other hand, Lisk’s philosophy is to be the imperfect stepping stone for early blockchain projects.

The fate of both projects however, ultimately rests in the success of the projects that are built on them.